by Richard Hall | Apr 25, 2022 | Small Business

What are the tax consequences of selling property used in your trade or business? There are many rules that can potentially apply to the sale of business property. Thus, to simplify discussion, let’s assume that the property you want to sell is land or depreciable...

by Jimmy Campoverde | Apr 18, 2022 | Small Business

Adding a new partner in a partnership has several financial and legal implications. Let’s say you and your partners are planning to admit a new partner. The new partner will acquire a one-third interest in the partnership by making a cash contribution to it. Let’s...

by Diogo P. Azevedo | Apr 11, 2022 | Small Business

Operating as an S corporation may help reduce federal employment taxes for small businesses in the right circumstances. Although S corporations may provide tax advantages over C corporations, there are some potentially costly tax issues that you should assess before...

by Diogo P. Azevedo | Mar 28, 2022 | Small Business

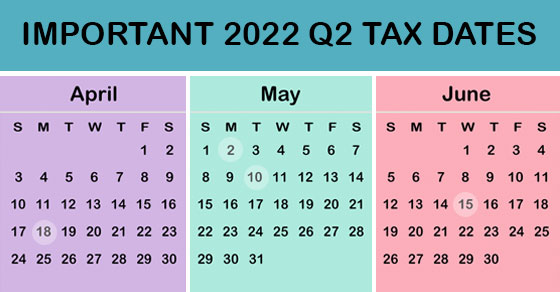

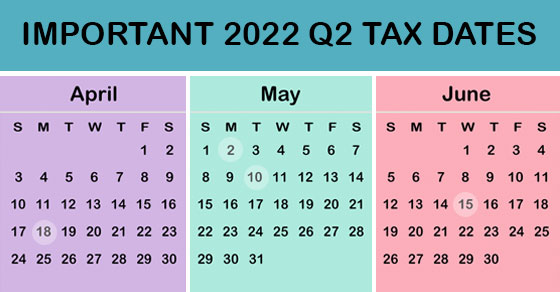

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting...

by Donald Bicking Jr. CPA, CTC | Mar 21, 2022 | Small Business

Typically, businesses want to delay recognition of taxable income into future years and accelerate deductions into the current year. But when is it prudent to do the opposite? And why would you want to? One reason might be tax law changes that raise tax rates....

by Diogo P. Azevedo | Mar 14, 2022 | Small Business

If your business doesn’t already have a retirement plan, now might be a good time to take the plunge. Current retirement plan rules allow for significant tax-deductible contributions. For example, if you’re self-employed and set up a SEP-IRA, you can contribute up to...

Recent Comments