by Richard Hall | Nov 1, 2022 | Small Business, Uncategorized

How much can you and your employees contribute to your 401(k)s next year — or other retirement plans? In Notice 2022-55, the IRS recently announced cost-of-living adjustments that apply to the dollar limitations for pensions, as well as other qualified retirement...

by Richard Hall | Oct 13, 2022 | Individual

If you’re interested in investing in tax-free municipal bonds, you may wonder if they’re really free of taxes. While the investment generally provides tax-free interest on the federal (and possibly state) level, there may be tax consequences. Here’s how the rules...

by Richard Hall | Oct 6, 2022 | Small Business

IRS audit rates are historically low, according to a recent Government Accountability Office (GAO) report, but that’s little consolation if your return is among those selected to be examined. Plus, the IRS recently received additional funding in the Inflation...

by Richard Hall | Sep 28, 2022 | Individual

Now that fall is officially here, it’s a good time to start taking steps that may lower your tax bill for this year and next. One of the first planning steps is to ascertain whether you’ll take the standard deduction or itemize deductions for 2022. Many taxpayers...

by Richard Hall | Sep 26, 2022 | Small Business

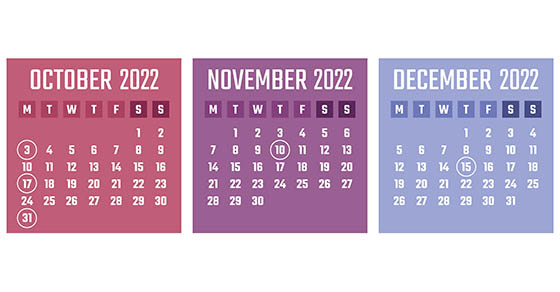

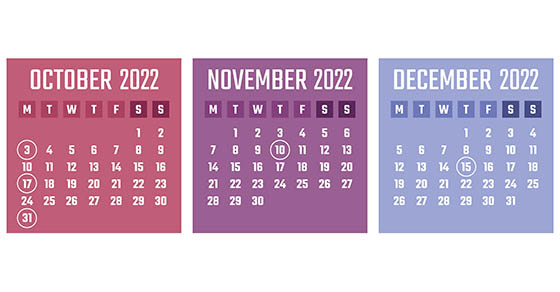

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all...

Recent Comments