by Donald Bicking Jr. CPA, CTC | Nov 7, 2022 | Small Business

No one needs to remind business owners that the cost of employee health care benefits keeps going up. One way to provide some of these benefits is through an employer-sponsored Health Savings Account (HSA). For eligible individuals, an HSA offers a tax-advantaged way...

by Richard Hall | Nov 1, 2022 | Small Business, Uncategorized

How much can you and your employees contribute to your 401(k)s next year — or other retirement plans? In Notice 2022-55, the IRS recently announced cost-of-living adjustments that apply to the dollar limitations for pensions, as well as other qualified retirement...

by Donald Bicking Jr. CPA, CTC | Oct 12, 2022 | Small Business

You and your small business are likely to incur a variety of local transportation costs each year. There are various tax implications for these expenses. First, what is “local transportation?” It refers to travel in which you aren’t away from your tax home (the city...

by Richard Hall | Oct 6, 2022 | Small Business

IRS audit rates are historically low, according to a recent Government Accountability Office (GAO) report, but that’s little consolation if your return is among those selected to be examined. Plus, the IRS recently received additional funding in the Inflation...

by Diogo P. Azevedo | Oct 5, 2022 | Small Business

In today’s tough job market and economy, the Work Opportunity Tax Credit (WOTC) may help employers. Many business owners are hiring and should be aware that the WOTC is available to employers that hire workers from targeted groups who face significant barriers to...

by Richard Hall | Sep 26, 2022 | Small Business

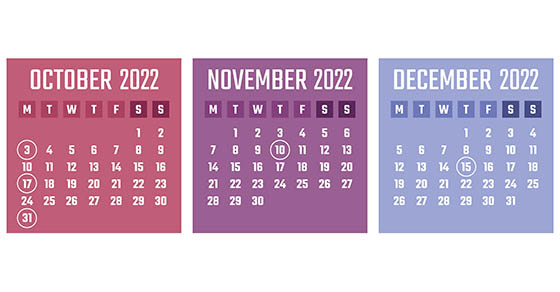

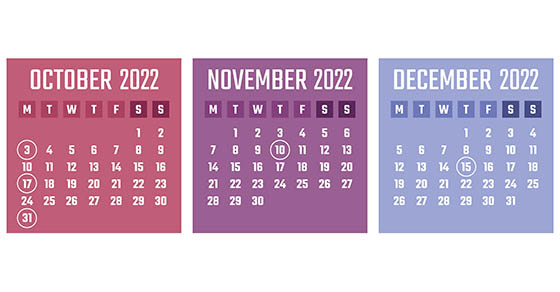

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all...

Recent Comments