Latest Articles

Want to turn a hobby into a business? Watch out for the tax rules

Like many people, you may have dreamed of turning a hobby into a regular business. You won’t have any tax headaches if your new business is profitable. But what if the new enterprise consistently generates losses (your deductions exceed income) and you claim them on...

The tax mechanics involved in the sale of trade or business property

What are the tax consequences of selling property used in your trade or business? There are many rules that can potentially apply to the sale of business property. Thus, to simplify discussion, let’s assume that the property you want to sell is land or depreciable...

Thinking about converting your home into a rental property?

In some cases, homeowners decide to move to new residences, but keep their present homes and rent them out. If you’re thinking of doing this, you’re probably aware of the financial risks and rewards. However, you also should know that renting out your home carries...

Tax considerations when adding a new partner at your business

Adding a new partner in a partnership has several financial and legal implications. Let’s say you and your partners are planning to admit a new partner. The new partner will acquire a one-third interest in the partnership by making a cash contribution to it. Let’s...

Once you file your tax return, consider these 3 issues

The tax filing deadline for 2021 tax returns is April 18 this year. After your 2021 tax return has been successfully filed with the IRS, there may still be some issues to bear in mind. Here are three considerations: 1. You can throw some tax records away now You...

Tax issues to assess when converting from a C corporation to an S corporation

Operating as an S corporation may help reduce federal employment taxes for small businesses in the right circumstances. Although S corporations may provide tax advantages over C corporations, there are some potentially costly tax issues that you should assess before...

Selling mutual fund shares: What are the tax implications?

If you’re an investor in mutual funds or you’re interested in putting some money into them, you’re not alone. According to the Investment Company Institute, a survey found 58.7 million households owned mutual funds in mid-2020. But despite their popularity, the tax...

Fully deduct business meals this year

The federal government is helping to pick up the tab for certain business meals. Under a provision that’s part of one of the COVID-19 relief laws, the usual deduction for 50% of the cost of business meals is doubled to 100% for food and beverages provided by...

It’s almost that time of year again! If you’re not ready, file for an extension

The clock is ticking down to the April 18 tax filing deadline. Sometimes, it’s not possible to gather your tax information and file by the due date. If you need more time, you should file for an extension on Form 4868. An extension will give you until October 17 to...

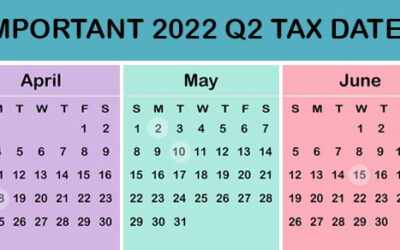

2022 Q2 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting...