by Richard Hall | Mar 30, 2022 | Individual

The clock is ticking down to the April 18 tax filing deadline. Sometimes, it’s not possible to gather your tax information and file by the due date. If you need more time, you should file for an extension on Form 4868. An extension will give you until October 17 to...

by Diogo P. Azevedo | Mar 28, 2022 | Small Business

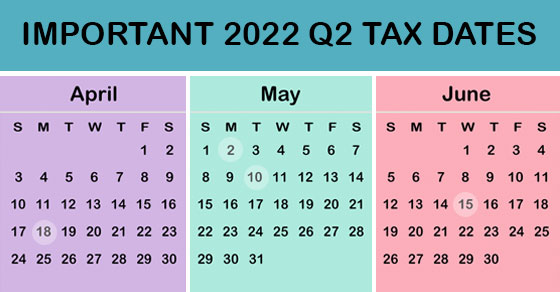

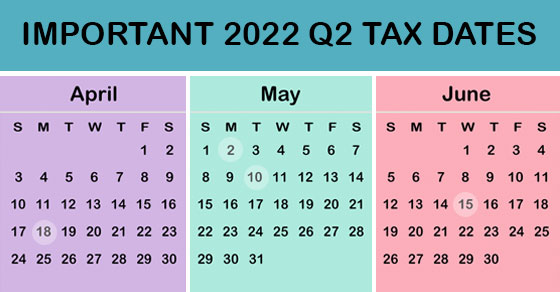

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting...

by Jimmy Campoverde | Mar 22, 2022 | Individual

Summer is just around the corner. If you’re fortunate enough to own a vacation home, you may wonder about the tax consequences of renting it out for part of the year. The tax treatment depends on how many days it’s rented and your level of personal use. Personal use...

by Donald Bicking Jr. CPA, CTC | Mar 21, 2022 | Small Business

Typically, businesses want to delay recognition of taxable income into future years and accelerate deductions into the current year. But when is it prudent to do the opposite? And why would you want to? One reason might be tax law changes that raise tax rates....

by Richard Hall | Mar 15, 2022 | Individual

Once a relatively obscure concept, “income in respect of a decedent” (IRD) may create a surprising tax bill for those who inherit certain types of property, such as IRAs or other retirement plans. Fortunately, there may be ways to minimize or even eliminate the IRD...

Recent Comments