by Richard Hall | Nov 15, 2021 | Individual

Married couples may not be able to save as much as they need for retirement when one spouse doesn’t work outside the home — perhaps so that spouse can take care of children or elderly parents. In general, an IRA contribution is allowed only if a taxpayer earns...

by Donald Bicking Jr. CPA, CTC | Nov 12, 2021 | Small Business

The Employee Retention Tax Credit (ERTC) is a valuable tax break that was extended and modified by the American Rescue Plan Act (ARPA), enacted in March of 2021. Here’s a rundown of the rules. Background Back in March of 2020, Congress originally enacted the ERTC in...

by Diogo P. Azevedo | Nov 11, 2021 | Small Business

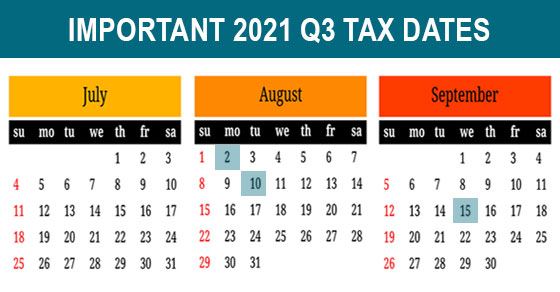

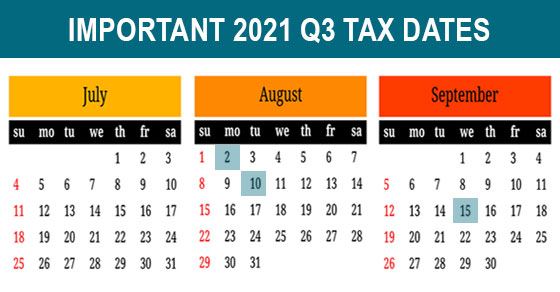

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2021. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all...

by Jimmy Campoverde | Nov 10, 2021 | Individual

Are you age 65 and older and have basic Medicare insurance? You may need to pay additional premiums to get the level of coverage you want. The premiums can be expensive, especially if you’re married and both you and your spouse are paying them. But there may be a...

by Matthew Cadira, CPA | Nov 9, 2021 | Small Business

As we continue to come out of the COVID-19 pandemic, you may be traveling again for business. Under tax law, there are a number of rules for deducting the cost of your out-of-town business travel within the United States. These rules apply if the business conducted...

Recent Comments