by Diogo P. Azevedo | Dec 20, 2021 | Individual

Employers offer 401(k) plans for many reasons, including to attract and retain talent. These plans help an employee accumulate a retirement nest egg on a tax-advantaged basis. If you’re thinking about participating in a plan at work, here are some of the features....

by Diogo P. Azevedo | Dec 15, 2021 | Small Business

If your business receives large amounts of cash or cash equivalents, you may be required to report these transactions to the IRS. What are the requirements? Each person who, in the course of operating a trade or business, receives more than $10,000 in cash in one...

by Diogo P. Azevedo | Nov 23, 2021 | Individual

The Infrastructure Investment and Jobs Act (IIJA) was signed into law on November 15, 2021. It includes new information reporting requirements that will generally apply to digital asset transactions starting in 2023. Cryptocurrency exchanges will be required to...

by Diogo P. Azevedo | Nov 18, 2021 | Individual

Do you have significant investment-related expenses, including the cost of subscriptions to financial services, home office expenses and clerical costs? Under current tax law, these expenses aren’t deductible through 2025 if they’re considered investment expenses for...

by Diogo P. Azevedo | Nov 11, 2021 | Small Business

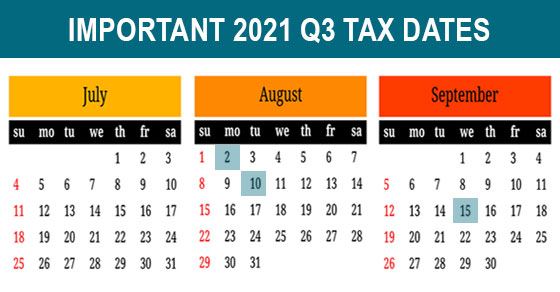

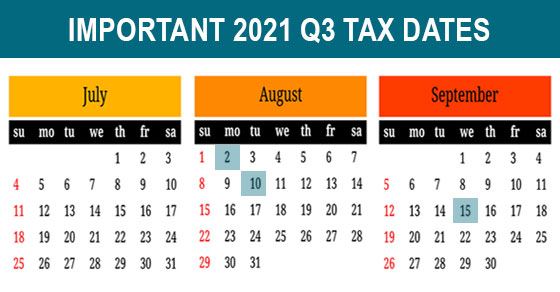

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2021. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all...

Recent Comments