by Diogo P. Azevedo | Apr 19, 2022 | Individual

In some cases, homeowners decide to move to new residences, but keep their present homes and rent them out. If you’re thinking of doing this, you’re probably aware of the financial risks and rewards. However, you also should know that renting out your home carries...

by Diogo P. Azevedo | Apr 11, 2022 | Small Business

Operating as an S corporation may help reduce federal employment taxes for small businesses in the right circumstances. Although S corporations may provide tax advantages over C corporations, there are some potentially costly tax issues that you should assess before...

by Diogo P. Azevedo | Mar 28, 2022 | Small Business

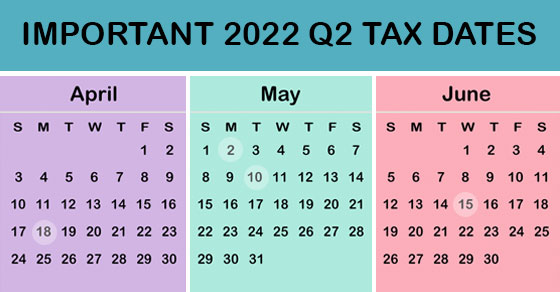

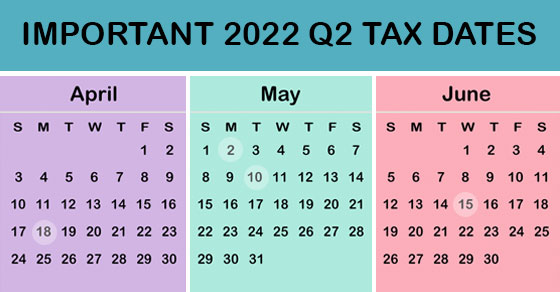

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting...

by Diogo P. Azevedo | Mar 14, 2022 | Small Business

If your business doesn’t already have a retirement plan, now might be a good time to take the plunge. Current retirement plan rules allow for significant tax-deductible contributions. For example, if you’re self-employed and set up a SEP-IRA, you can contribute up to...

by Diogo P. Azevedo | Mar 1, 2022 | Individual

If you’re getting ready to file your 2021 tax return, and your tax bill is more than you’d like, there might still be a way to lower it. If you’re eligible, you can make a deductible contribution to a traditional IRA right up until the April 18, 2022, filing date and...

Recent Comments